The modern coworking business thrives on predictable recurring revenue. However, every dollar earned through traditional credit card processing is immediately diminished by steep, percentage-based transaction fees. In a market where margins are constantly scrutinized, the ability to control operational costs is the true competitive edge.

The solution is not complex, but strategic: embracing automated clearing house (ACH) payments. For the flexible workspace operator, ACH is more than just a payment option; it’s a financial firewall that protects profitability, guarantees cash flow reliability, and dramatically reduces administrative overhead. By moving the majority of your recurring membership fees to ACH, you fundamentally strengthen the financial resilience of your entire operation.

The critical financial case: protecting your profit margin

The most compelling argument for ACH is its immediate, measurable impact on your profit and loss (P&L) statement. This advantage is rooted in the structure of payment processing costs.

The hidden cost of card dependence

Credit card firms charge percentage-based fees (interchange, assessment, and markup fees), meaning the more revenue you generate, the more you pay the processor.

Consider a multi-location operator with 50 private offices, each generating an average of $1,500 per month.

| Payment method | Annual revenue from 50 offices | Typical fee structure | Estimated annual cost |

| Credit card | $900,000 | $\approx 3.0% + $0.30$ per transaction | $27,000+ |

| ACH direct debit | $900,000 | Fixed fee (often $\leq $5.00$ per transaction) | $3,000 |

By transitioning this revenue stream to ACH, the operator retains an estimated $24,000 annually pure, direct profit that can be reinvested into amenities, technology, or community management, thereby enhancing member value without raising prices. The cost of an ACH transaction remains consistently low, regardless of the revenue size. For high-value, corporate private offices, the backbone of today's flexible market, this difference is monumental.

Strategic implementation: segmenting clients and controlling fees

The most effective ACH strategy segments members by their revenue potential and reframes payment processing costs as a member choice.

Strategy 1: the B2B mandate (enterprise & corporate clients)

For enterprise clients and large teams generating high revenue (e.g., over $5,000/month), ACH should be the default and non-negotiable billing method.

- Zero limits for enterprise clients: as flexible workspaces attract larger corporate clients, the transaction size grows. Corporate credit cards often have strict, undisclosed spending limits. An ACH transfer, which is a bank-to-bank settlement, is immune to these caps, guaranteeing reliable collection for your most valuable streams.

- Billing procedure, not option: for these clients, the billing method is your standard B2B procedure, often replacing complex manual bank wire processes. This isn't an "option"; it's a condition that protects both parties from the headache of failed payments.

Discover how hundreds of spaces worldwide unlock success and grow better with Spacebring

Strategy 2: the convenience fee (individuals & small teams)

Individual members and small teams are the most likely to use credit cards to rack up reward points ("points chasers"). This is where the incentive must be framed to align the member's choice with your profitability.

- Reframing the cost: instead of offering a small, absorbed discount, reframe the 3% as a convenience fee the member chooses to incur for their own perk (points, easy input).

- Option A (preferred): pay via ACH (Free / 0% processing fee).

- Option B (convenience): pay via Credit Card (Adds a 3% processing fee).

The cost of the fee is still significantly lower than the expense absorbed by the operator, ensuring you profit while making the financial case clear to the member.

Operational excellence: cash flow reliability and automation

Cash flow instability is the primary enemy of any subscription-based business. ACH payments dramatically improve the reliability and efficiency of your recurring billing cycle.

The end of payment churn and expiry risk

Credit card failure rates often hovering between 3% and 5% each month are a silent killer of operational efficiency.

- The ACH reliability factor: direct bank account details are stable. They rarely expire, and the rate of account turnover is minuscule compared to card expiry cycles. ACH failure rates drop to below 1%, virtually eliminating the most common source of monthly chasing.

- Agility in plan changes: in a flexible world, member plans change frequently. ACH allows operators to change the payment amount and frequency quickly within the billing system. This provides a better member experience without the administrative hurdle of requiring the member to re-input or re-authorize a new payment method every time.

Technology imperative: frictionless setup is mandatory

Manually collecting bank details feels insecure and creates significant administrative friction. Modern ACH implementation is not about paper forms; it must be digital and secure.

- Solving setup friction: operators must use a modern management platform that integrates a service like Plaid. This allows members to sign up for ACH by simply logging into their online banking one time. It's fast, secure, and verifies the account instantly, solving the setup friction, security concerns, and potential for typos all at once. This technological layer is what makes the entire strategy feasible at scale.

- Automation benefits: automated ACH billing easily manages invoicing, payments, and failed transactions. This saves time professionally, allowing community managers to focus on high-priority tasks like hosting events, keeping members happy, and nurturing relationships.

Strategic implications: security and trust

The shift to ACH is a technological and cultural decision that supports a long-term strategy for growth and member trust.

- Security and trust: ACH has been the backbone of payroll and tax payments for decades, establishing it as a highly secure and reliable method administered by the National Automated Clearing House Association (NACHA). Members can be assured their funds are being transferred through a safe, regulated network.

- Building member trust: when a member signs up for an ACH mandate, you establish your brand as a professional, trustworthy partner. You demonstrate reliability and efficiency in handling their banking details.

Addressing the nuances

While the strategic advantages are clear, operators must manage the two minor, perceived drawbacks:

- Delayed funds: the typical two to three business day settlement time is a negligible factor when billing is planned. Simply initiate the payment cycle a few days before the target due date.

- Dispute resolution: while resolving a misdirected ACH payment can be more involved than a simple card chargeback, the rarity of these incidents means the system is a net positive. The administrative time saved by avoiding a 3% to 5% failure rate far outweighs the time spent resolving a fractional issue.

By making ACH payments the preferred and incentivized method, you shift your coworking space's financial operations from reactive cost management to proactive profit generation, securing your growth trajectory in the competitive flexible workspace industry.

How to accept ACH payments at your coworking space

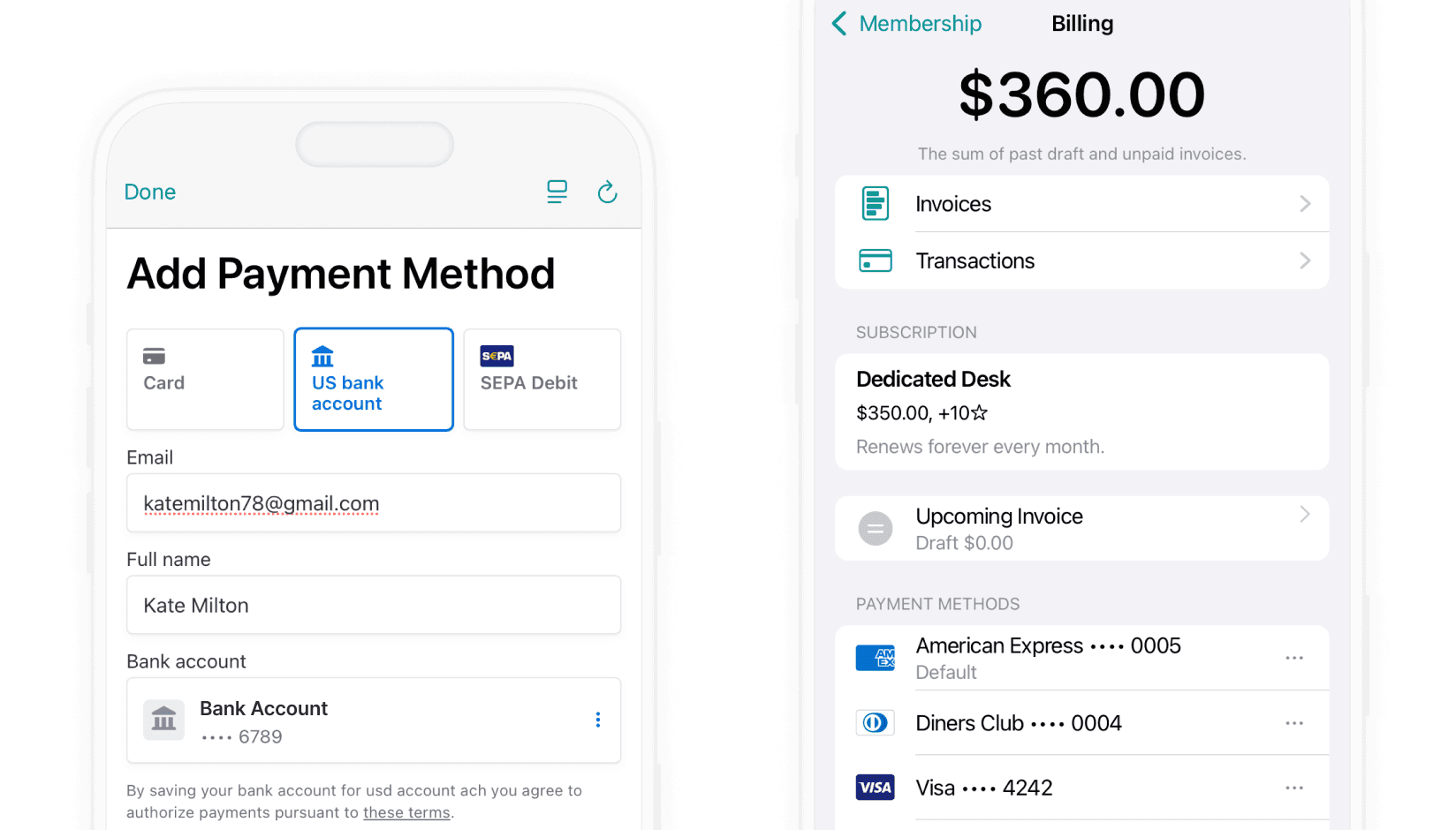

For Spacebring customers it is really easy to start accepting ACH payments. The platform’s powerful billing automation allows spaces to generate invoices and collect payments through bank cards such as Visa and Mastercard. When tenants move in, you just assign a membership plan and Spacebring takes care of invoices and payment collection.

In addition to cards, users can connect their bank accounts for payment settlement. The process of adding an account is as easy as adding a card. When the account is connected, you will be able to charge it in a click, just like you do with members’ cards.

The feature is free to use on Spacebring side. Unlike other coworking management systems, Spacebring doesn’t charge any commission from customers for connecting or using ACH direct debit payments. You pay only Stripe’s payment processing fees that depend on the country but stay really low compared to cards.

Not a Spacebring customer yet?