Getting your head around new eInvoicing mandates like Peppol and ViDA can feel like a lot. The good news is, sending the actual eInvoice isn't the complicated part. The real challenge for coworking operators is just understanding all the new rules and managing the technical switch to get your billing system compliant.

First, an eInvoice is not a PDF you email. It's a structured data file (like XML) sent directly between billing systems through a secure, government-approved network.

Trying to handle this manually is nearly impossible. Because your government is mandating new digital tax rules around 2026, your B2B members will soon need compliant eInvoices from you. You'll also probably have to digitally report all your B2C sales to the tax office. Not being able to do this risks fines or simply not getting paid on time.

Here is a 5-step plan to solve this problem for good and get back to running your community.

TL;DR: The 60-second solution

- The problem: eInvoicing (a structured data file, not a PDF) is now mandatory for B2B transactions in many countries.

- The urgency: Don't be fooled by the 2030 EU deadline. Domestic mandates are here: Germany (receiving now, sending in 2027), Belgium (Jan 2026), Poland (May 2026), and France (Sept 2026).

- The "broken stack": Trying to "patch" your coworking software, accounting tool (Xero/QuickBooks), and a third eInvoicing tool is an administrative nightmare that guarantees manual errors and compliance risks.

- The solution: This is a member data problem, not a billing problem. A holistic platform like Spacebring solves it by capturing the correct legal/tax data from B2B members at sign-up and automating the entire compliant billing process from one place.

Step 1: Know your mandate (the "what" & "when")

Why is this happening? Simply put, governments worldwide are cracking down on tax fraud and want to digitize B2B transactions. This isn't optional; it's a new, mandatory requirement for doing business.

The tricky part is that while the trend is global, the rules are local. You'll hear a lot of confusing terms, but here are the main ones to recognize:

- Peppol: This is the most common network, used in Australia, New Zealand, Singapore, Japan, and much of Europe.

- ViDA(VAT in the Digital Age): This is the major new mandate coming for the entire European Union.

- ZUGFeRD/XRechnung: These are examples of specific national standards from Germany; other countries have their own, like KSeF in Poland.

Don't get overwhelmed by the jargon. You don't need to be an expert.

Your only job is to find two simple facts for your location:

- What network does my country use? (Is it Peppol? Something else?)

- When is the mandatory deadline for B2B transactions?

A quick search for "[Your Country] B2B eInvoicing mandate" will usually get you the answer.

Step 2: Audit your members (the "who")

Before you even think about eInvoicing software solutions, you need to know exactly who this applies to. This is the most practical place to start.

Your action here is simple: go through your member list.

Your goal is to segment every member into one of two buckets:

- B2C (Business-to-Consumer): These are your individual freelancers, sole traders, or hobbyists. Invoices still need to be issued, but sending a formal eInvoice is usually optional, though it's often recommended by governments.

- B2B (Business-to-Business): These are the registered companies that rent your offices and desks. They are the main focus of the new eInvoicing regulations.

Once you have your customer list, ask the critical question: "Do I have their correct, legally required billing info?"

This is the number one failure point. A PDF invoice might work with "Mike's Tech Co," but a government eInvoicing network won't. You absolutely must have their:

- Correct Legal Business Name

- Billing details, such as street address, city, postal code

- VAT / Tax ID Number

- Peppol ID (or other eInvoicing address)

Now, imagine going through your list of 50 members, emailing each one to chase down this data, and then manually typing it all into a new system without a single typo.

This is exactly where the real headache begins.

Step 3: Map your current "billing stack" (the "how")

Now, look at the tools you use today to get paid. How do you bill your members right now?

Most spaces have a messy, disconnected "billing stack" that looks something like this:

- Tool 1: Your coworking software: This is where you manage memberships, room bookings, and member data. Usually integrates with payments gateways.

- Tool 2: Your accounting software: This is where you actually create and send invoices (like Xero, QuickBooks, etc.).

- Tool 3: Spreadsheets: This is the "glue." You use it for tracking who paid, correcting invoice errors, or making notes.

- Tool 4 (The new problem): To be compliant, you'll now have to add a separate, third-party eInvoicing tool (an "Access Point") that you have to pay for.

This is where the real nightmare starts.

Your member data lives in one system, your invoices are created in another, and your compliance happens in a third.

Every single month, you or your manager will be manually exporting data, importing it into another tool, and double-checking everything, just hoping nothing breaks. One typo in a member's VAT ID, and the entire process fails.

Step 4: Expose the hidden costs of "patching" it

It’s tempting to just find a quick, cheap "patch"—like bolting on a separate eInvoicing tool—just to tick the compliance box.

But this "easy" fix isn't easy. It creates three new problems that cost you time and money.

1. The admin time sink

Your community manager is now also an part-time invoicing clerk. Every month, they'll waste hours manually exporting member data from one system and importing it into another, all while spot-checking for errors. When an invoice is inevitably rejected for a typo, they're the ones who have to dig through spreadsheets to find the mistake and resend it.

2. Member frustration

This patchwork system is fragile. What happens when your invoice is rejected because their accounting system can't read it? Or what if the data you entered from your spreadsheet was outdated? They don't blame the system; they blame you. It makes your space look disorganized and creates friction over payments.

3. The compliance risk

With multiple, disconnected systems, you have no single source of truth. Are you 100% sure the invoice you sent from your accounting tool perfectly matches the active membership contract in your coworking software? When data lives in three different places, mistakes are guaranteed. This isn't just bad billing; it's a compliance risk.

Discover how hundreds of spaces worldwide unlock success and grow better with Spacebring

Step 5: Solve the entire problem, not the symptom

This is where you get your time back. You can see that eInvoicing isn't just a "billing" problem. It's a "member data" problem.

The only real, long-term solution is to have a single platform where your member data, contracts, billing, and compliance are all connected from day one.

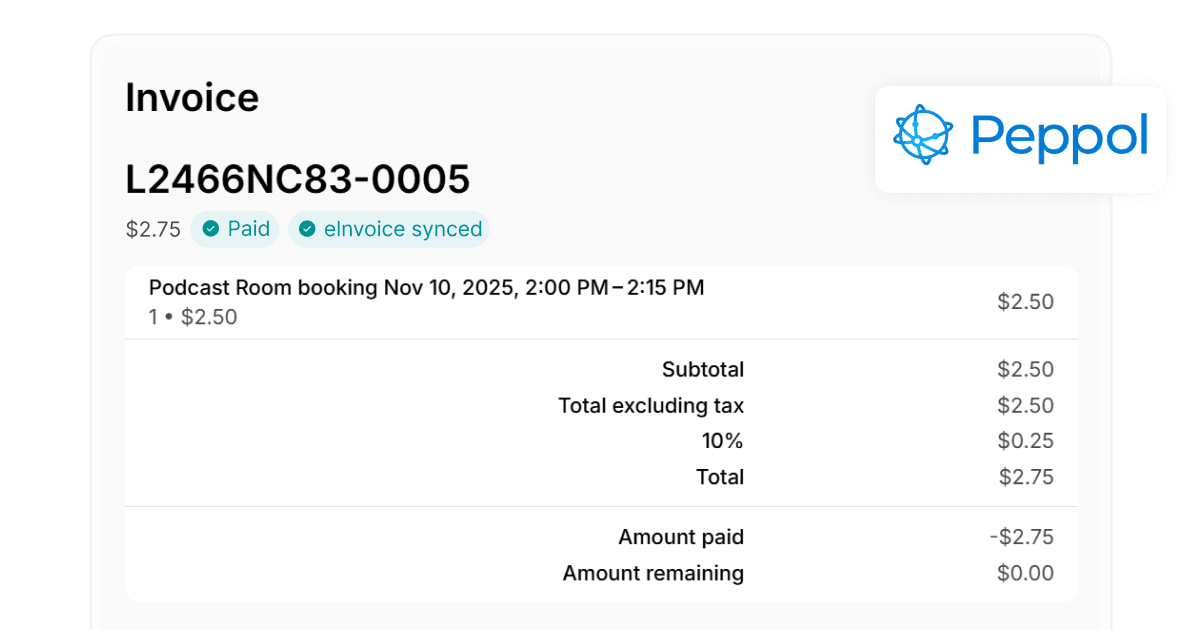

This is how it should work. This is how it works in Spacebring eInvoicing for coworking spaces:

- A new company (your B2B member) signs up through your Spacebring portal.

- During sign-up, they are required to enter their Legal Business Name, billing details, and Tax ID to complete their profile. The data is captured once, correctly, at the source.

- When it's time to bill, the system automatically generates a compliant invoice using this verified data.

- When the invoice is issued, Spacebring formats the eInvoice correctly and sends it directly to the official network (like Peppol) for you.

That's it.

No manual data entry. No spreadsheets. No paying for extra third-party tools. Just compliance.

Your headache is gone

You can spend your time worrying about ZUGFeRD, Peppol IDs, and ViDA... or you can let your software handle it.

Stop patching old systems together. Spacebring is the holistic platform built to run your entire coworking space, from member sign-up to full eInvoicing compliance.

Book a demo today and let us show you how we can solve all your problems at once.

Frequently Asked Questions (FAQ)

Q: What's the real difference between an eInvoice and a PDF invoice?

A: A PDF is an electronic invoice designed for humans. It looks nice, with your logo and tables. But someone has to manually re-type that information into their accounting system.

An eInvoice (like for Peppol) is a structured data file designed for computers. It's sent directly from your software to their software, and the data is imported automatically. It completely removes the manual step.

Q: I heard the deadline is 2030. Why the rush?

A: This is a critical misconception. The 2030 deadline is for the EU-wide ViDA rules (for intra-EU cross-border transactions). The real, urgent deadlines are the domestic B2B mandates in individual countries.

- Germany: Businesses must be able to receive eInvoices now (since Jan 1, 2025).

- Belgium: B2B eInvoicing is fully mandatory from January 1, 2026.

- Poland: Mandatory from February 1, 2026, for large companies, and from April 1, 2026, for all other businesses.

- France: All businesses must be able to receive eInvoices from September 1, 2026. The time to get your system in order is now.

Q: Can't my accounting software (like Xero or QuickBooks) handle this?

A: While some accounting tools are adding eInvoicing features, they don't solve your core problem. Your accounting software doesn't know about your member contracts, room bookings, or add-on services. You still have to manually export that data from your coworking software and re-type it into your accounting tool. This "broken stack" is where the errors, compliance risks, and wasted admin hours happen.

Q: Do I need to worry about this for my freelancer or individual (B2C) members?

A: For now, no. These mandates are almost exclusively focused on B2B (business-to-business) transactions. However, the new ViDA rules for the "platform economy" (targeting accommodation and transport platforms by 2028-2030) show that tax authorities want visibility into all transaction types. Your priority is to fix your B2B billing first.

Q: What does Spacebring actually do to solve this? A: Spacebring handles the entire process from start to finish.

- Captures data: It requires your members to enter their correct Legal Name, Tax/VAT ID and billing details during sign-up. This data is automatically validated to avoid errors.

- Connects systems: It's directly integrated with the official eInvoicing networks (like Peppol).

- Automates billing: When you bill a member, Spacebring automatically generates the fully compliant eInvoice with the correct data and sends it through the correct network.

You don't need a separate tool, and there is no manual data entry. It's compliance on autopilot.