The coworking industry is on the rise worldwide. Fueled by the popularity of hybrid and remote work, this trend shows that well-equipped coworking spaces are a good investment everywhere, not just in the US, Europe, or Asia.

Thanks to big brands like WeWork and IGW, there are now over 41,500 coworking spaces in cities around the world. Their (and others') global success is a clear sign that the market is growing, and that global expansion may be the next natural step for a coworking company that has conquered the local and regional markets.

But, is there room for newcomers? And can you be successful on your first try?

It depends. Managing diverse legal, tax, and labor regulations across different countries is a massive administrative burden. Then, there’s the increased financial complexity, especially when recurring expenses are tied to multiple currencies.

Today, we’ll focus on the multi-currency part of the problem. We’ll dissect the most challenging legal and financial pitfalls that come with it and what big brands do about it.

Risks to be aware of from the start

A global presence boosts your brand's perceived authority and attracts a wider range of clients. As you grow, you have more power in negotiations with suppliers of technology, real estate, and vendor services globally.

All these are like honey for an entrepreneur’s soul, but it’s important not to allow the many and impressive benefits to blindside you.

There are many risks hidden in the shadows, and if you’re not aware of them, things could get ugly, fast. Here are a few examples:

1. Revenue-to-expense mismatch

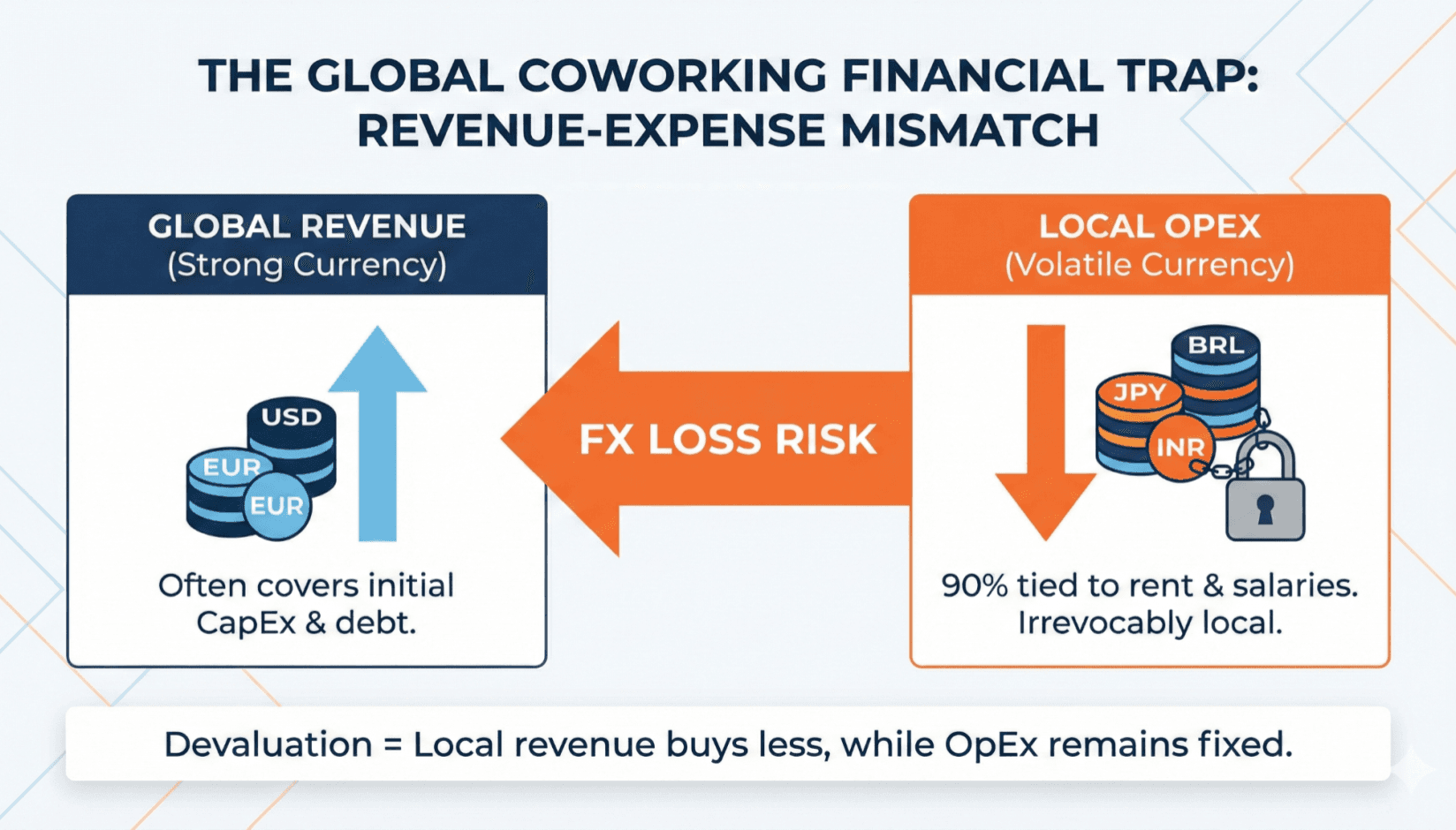

The assumption that the operational currency exchange rate (FX) risk is perfectly hedged or neutralized by the stability of your core revenue stream can be fatal for your global plans.

The common, incorrect assumption is:

"Our dollar/euro-based revenue will cover our dollar/euro-based debt, so local currency fluctuations only impact our profit margin, which we can absorb."

The problem with this sort of thinking

Initial Capital Expenditure (CapEx) for build-out (e.g., furniture, major IT, project management) is usually invoiced in a stable currency (USD/EUR). However, the ongoing, massive portion of Operational Expenditure (OpEx) is irrevocably local.

In a new market, most of your OpEx (up to 90%) is tied up in rent or lease payments and salaries, which are fixed or indexed to the local currency. Your revenue is also collected in the local currency (Brazilian Real, Japanese Yen, etc.) unless stated otherwise.

However, the repayment of the initial CapEx loan or global corporate overhead may be in the home currency (USD/EUR).

Now, say the local currency undergoes a sudden, significant devaluation, like a 20% drop. It happens; that’s how financial exchange markets work.

For you, this drop means your local revenue, when converted back to the home currency for global reporting or debt service, buys 20% less. Yet, your local OpEx (especially the rent/lease) remains payable and unhedged. This rapidly turns positive local unit economics into a massive, unrecoverable FX loss at the consolidated level, draining corporate liquidity faster than expected.

2. Risky pairings

When dealing with multiple currencies, some pairings are better than others. For instance, it’s easy to work with a USD-EUR or USD-Pound pairing because these are all strong currencies that don’t fluctuate too abruptly.

On the other hand, a USD-Indian Rupee or EUR-Indonesian Rupiah pairing can be disastrous. And not because of the fluctuations and differences in currency power.

The main risk is that the local currency is issued by a controlled market. In this case, governments impose limits, requirements, and strict administrative procedures on how and when local profits can be remitted to the parent company.

You must provide extensive documentation (tax forms, audited financial statements, proof that local taxes have been paid) to justify every single dollar that leaves the country. This dramatically slows cash velocity and can trap profits in the local market.

3. Real estate and lease issues

The laws governing foreign ownership of assets and land use are often complex, non-transparent, and highly political (especially in developing markets). But then the government may impose rules on whether real estate contracts (leases) can be indexed to an external currency (like the USD).

This forces you to sign long-term, high-value local-currency leases, thereby magnifying the OpEx-revenue mismatch discussed earlier. Plus, foreign entities in these jurisdictions are often subject to more intense scrutiny and capricious tax decisions, with the burden of proof heavily leaning on the foreign investor.

Risk-management strategies inspired by big brands

When you’re dealing with multiple currencies, FX volatility is part of the business. This is why global coworking big brands treat currency hedging as a mandatory cost of doing business.

Here are a few strategies that can help balance things out:

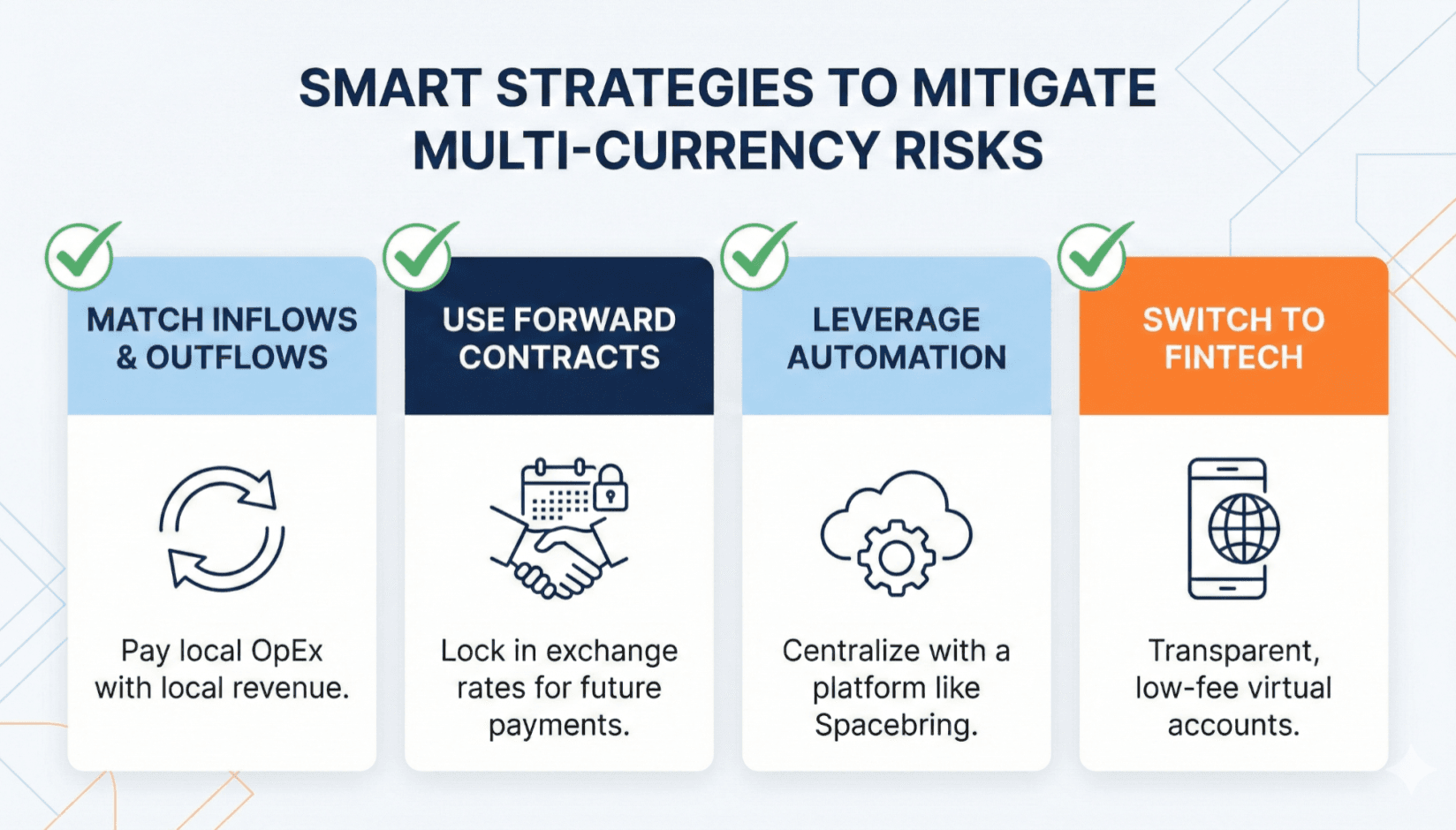

1. Match inflows and outflows

Aim to denominate as much local cost (OpEx) as possible in the local currency where the revenue is earned. For example, a Euro-based entity pays its Euro rent and Euro salaries from Euro membership fees, minimizing conversion risk.

2. Financing localisation

Where possible, secure local financing (e.g., local bank loans) for CapEx, creating a liability in the same currency as the asset's revenue stream. This means FX fluctuations on revenue are offset by corresponding FX fluctuations on debt servicing.

Speaking of debt, if you had to dig deep into your personal funds to launch your future global empire, but things aren’t going as well as expected, don’t despair. There are always options around you, and in a currency you’re comfortable with. For instance, a reliable debt relief solution can help you reduce the financial pressure on your personal accounts.

3. Forward contracts

Your biggest, most predictable foreign currency exposure is your monthly rent payment (OpEx), which is typically fixed in the local currency for years.

A forward contract allows you to lock in an exchange rate today for a specific future date (e.g., 12 or 24 months out). This guarantees the US Dollar value of a client's Euro payment, preserving the contracted gross margin regardless of rate movements.

Let’s say your rent is EUR 50,000, due in 90 days. Contact your commercial bank or a specialized FX broker and book a deliverable forward contract for that specific amount and date. This locks in the exchange rate today.

As a result, you now know the exact home currency cost (e.g., USD) of that future rent payment. This moves the cost certainty from the volatile spot rate to a fixed budgeted rate.

4. Document and archive everything

Multi-currency payments involve sensitive data such as bank account details, vendor contracts, and client invoices. Loss, unauthorized access, or accidental deletion of this information can lead to compliance violations or operational disruptions.

Since everything happens electronically nowadays, use email archiving to store and encrypt all your business communications. Also, make sure you receive an email with the details of every transaction and fees, to create an electronic paper trail. It may come in handy during audits or when you‘re trying to solve a dispute.

5. Use automation

Managing multiple locations across the world can be a pain without the right tools. This is where a flexible space management platform like Spacebring truly shows its mettle.

Spacebring offers a single, cloud-based dashboard for managing multiple locations and currencies, eliminating the need for localized, disparate systems. Also, it automates invoicing, billing, and payments, with the option to set a multi-currency system.

Every interaction and transaction is etched and stored in the system, so it’s easy to establish a chronological order of events, should you ever need one.

Generate recurring revenue and offer exceptional customer experience at your shared or coworking space

Hidden fees can be your undoing

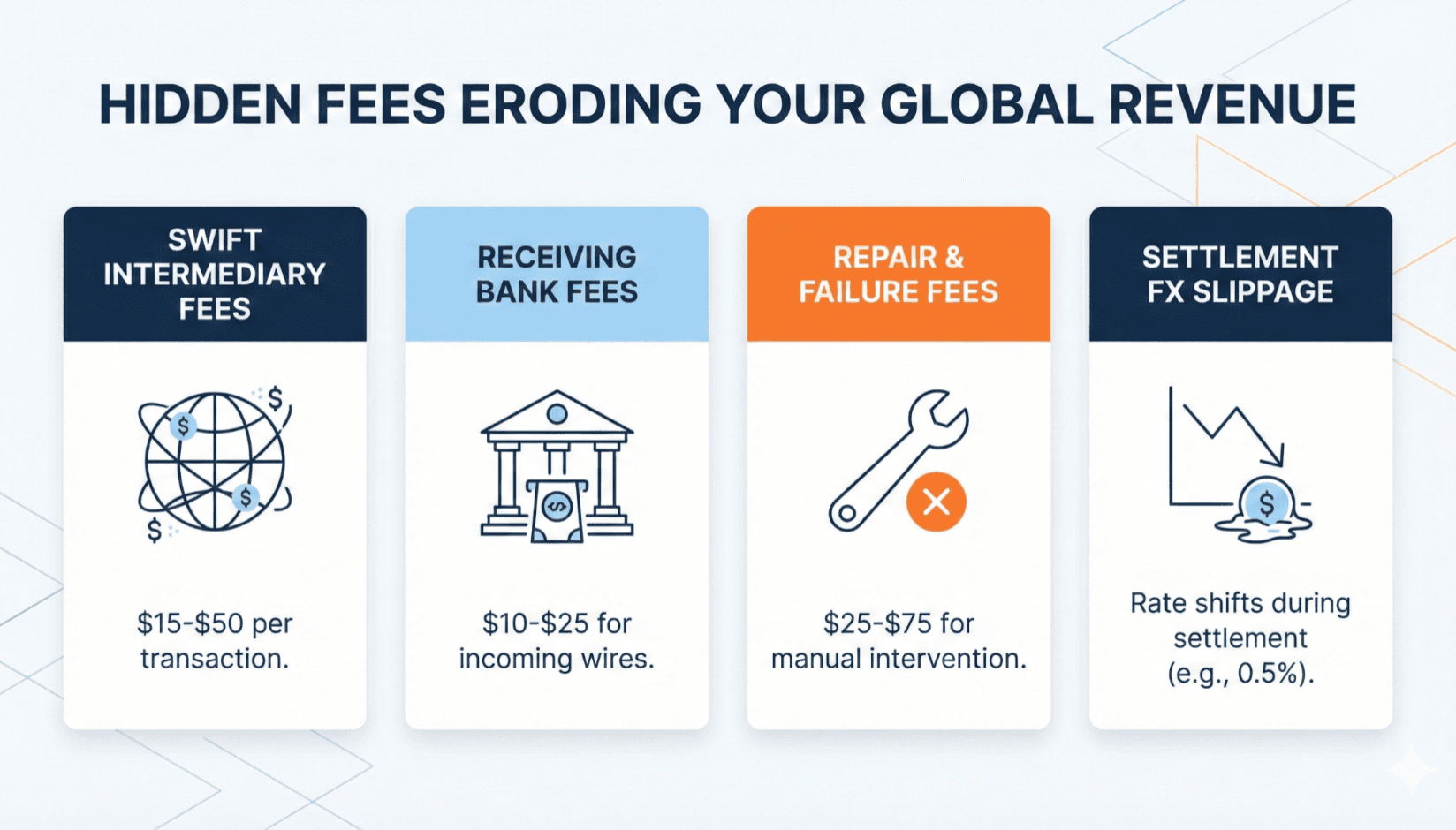

We’re not trying to be dramatic, but if you don’t know where to look, these costs will quietly erode your revenue. These are additional costs beyond the advertised currency conversion fees that surface at the transaction settlement phase and within the traditional banking network.

Here are a few examples:

- Intermediary bank fees (SWIFT): When a payment from a member's bank to your receiving bank requires routing through one or more correspondent banks (SWIFT network), each one takes a "lifting fee" ($15–$50 per transaction). These fees are deducted from the principal amount, meaning you receive less than what the member was billed, and you often don't see the deduction until reconciliation.

- Receiving bank fees: Even if the funds clear the network, your local branch/bank may charge a fixed fee ($10–$25) to process the incoming international wire and deposit it into your account.

- Repair and failure fees: If a payment fails to process straight-through (Non-STP) due to incorrect formatting, missing reference codes, or regulatory flags, the banks charge a manual intervention/repair fee ($25–$75). This happens frequently with enterprise clients that use outdated treasury systems. It adds cost, creates a massive reconciliation effort for your finance team, and delays cash flow.

- Settlement FX slippage: When a payment processor collects funds in a local currency but settles them to your corporate bank account in your home currency days later, the exchange rate may shift between the collection time and the settlement time. Even a 0.5% rate movement in two days is FX slippage, eating into your margin, especially during high volatility.

Identify the fees eating your revenue

You cannot manage what you don’t measure, so the first step toward guarding your revenue is accountability.

Many small fees accumulate unnoticed across international transactions. AI can analyze transaction patterns, uncover hidden costs, and suggest optimizations. By highlighting inefficiencies, AI enables smarter decisions on payment routing and bank selection.

AI ROI for enterprise helps enterprises quantify these benefits. It ensures that AI not only finds hidden costs but also delivers measurable savings, helping global businesses protect revenue and optimize cash flow.

Start by requesting a copy of the MT103 SWIFT message from your payment platform for international wire transfers. This document itemizes every intermediary bank, the fee it deducted, and the remaining principal amount.

Next, keep track of all FX costs and add them as a separate cost center (FX & Transaction Loss) in your general ledger.

To calculate the FX costs, establish the mid-market rate (the real exchange rate seen on Reuters/Bloomberg) as the absolute zero-markup baseline. When funds arrive, calculate the effective rate you received. The difference between the MMR and your received rate is your all-in FX cost.

Tip: The situation may vary by company and market, so it’s best to consult a financial expert specializing in international transactions. They will be able to offer personalized advice to help you track and minimize these fees.

How to avoid getting ripped off

Traditional banking methods can work to your disadvantage in this case, so why not look for solutions elsewhere?

For instance, you could switch to FinTech providers (e.g., Wise, Airwallex, specialized FX brokers). These platforms allow you to open virtual local bank accounts in key markets (USD, EUR, GBP, CAD, etc.). You’ll still have to pay currency fees, but they will be transparent, controllable, and significantly lower than the total fees hidden in the traditional banking system.

When clients send money to your local virtual account, their payment becomes a domestic SEPA transfer, which is cheap or free and bypasses the expensive, non-transparent SWIFT intermediary network entirely.

This move puts you in control of the collected foreign currency. You now decide when to convert it (optimizing for the best rate) and who does the conversion (like a provider with a tiny, transparent spread), eliminating the bank's opacity and the random intermediary fees.

In conclusion: weigh the risks & benefits

Every step you take implies risks. And when you’re aiming for the world, the risks are that much bigger. But if you’re aware of the legal and financial pitfalls, especially when dealing with multi-currency payments, it’s easy to prepare and find solutions. Now, go and establish your empire!