As the founder of a coworking space, your vision is to cultivate a dynamic environment for innovation and community. However, the reality of day-to-day operations can often involve significant administrative challenges, from managing invoices to ensuring timely payment collection and maintaining tax compliance.

These operational burdens can divert your focus from strategic growth and community engagement. Inaccurate or delayed invoicing not only impacts cash flow but can also introduce risks related to VAT compliance, a critical consideration for any business in the GCC.

Fortunately, there is a strategic solution. By implementing the right automated systems, you can streamline your financial processes, enhance member satisfaction, and dedicate your resources to building your business. This guide outlines a clear, five-step process to achieve this.

Step 1: Select a management platform aligned with GCC business needs

The foundation of an efficient operation is a robust management software platform. For coworking spaces in the GCC, it is essential to select a solution that is specifically equipped to handle the nuances of the regional market.

Consider these essential criteria during your selection process:

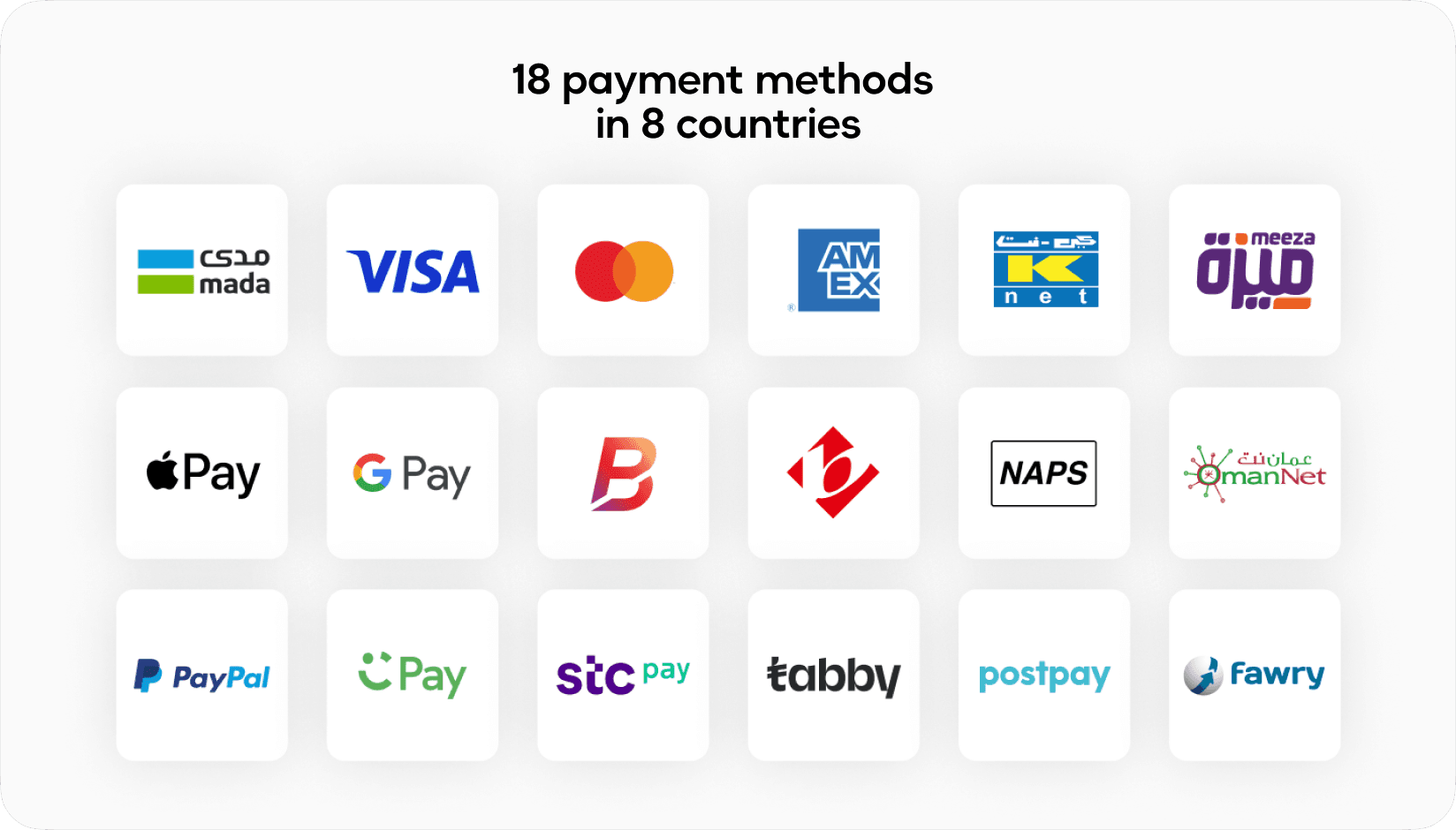

- Integration with regional payment gateways: Your platform must offer seamless integration with a leading Middle Eastern payment gateway like Tap. This is critical for accepting the diverse payment methods preferred by your clientele, including local debit cards such as Mada (Saudi Arabia) and KNET (Kuwait), alongside international cards and digital wallets like Apple Pay. This is similar to getting a high risk merchant account if you’re in a high-risk industry.

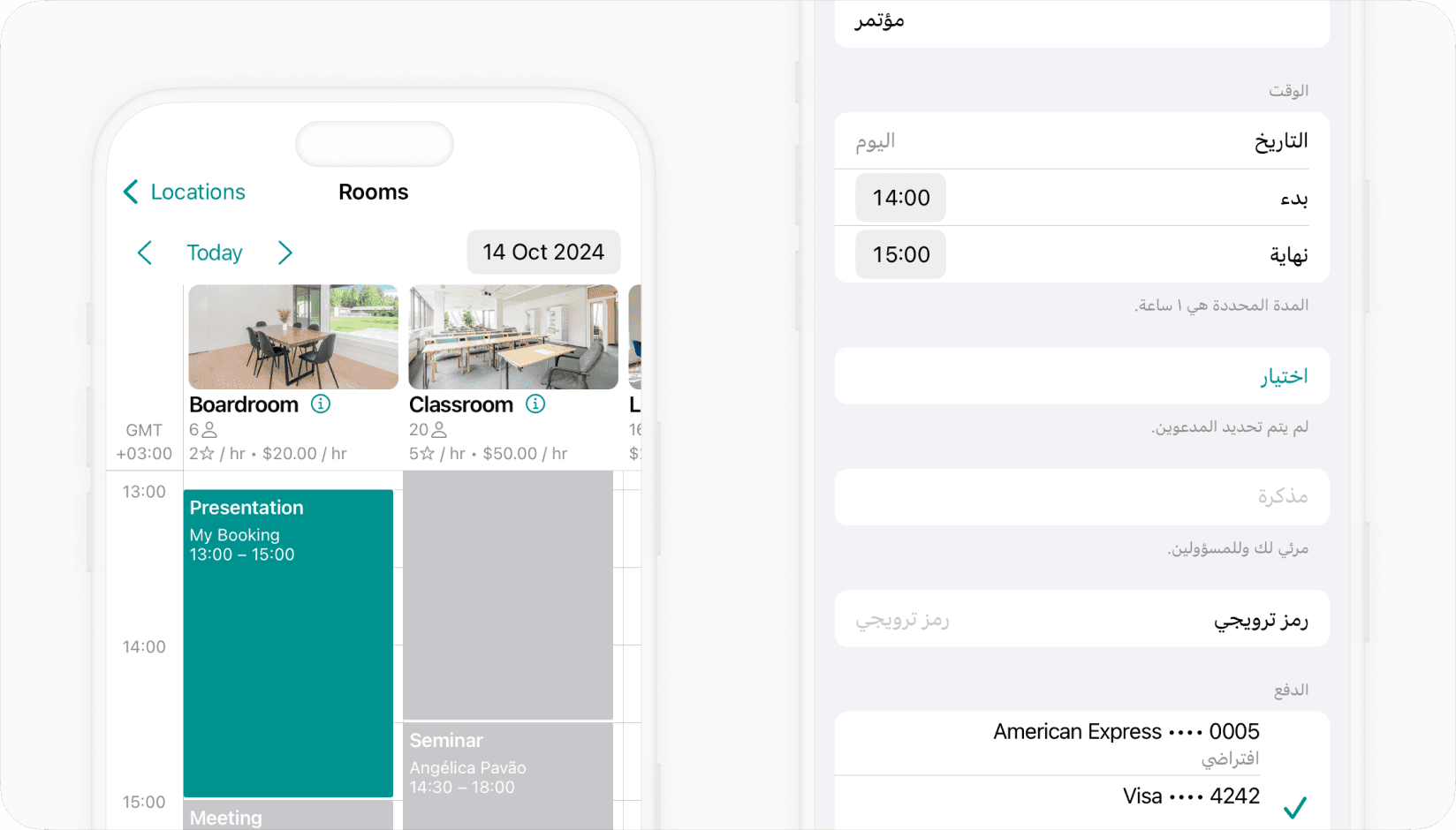

- Full Arabic language support: To deliver a superior and inclusive member experience, your platform's interface—both for your staff and your members—must be fully functional in Arabic. This demonstrates a commitment to your local market and ensures clarity in all communications, from bookings to billing. Platforms such as Spacebring are designed with this capability.

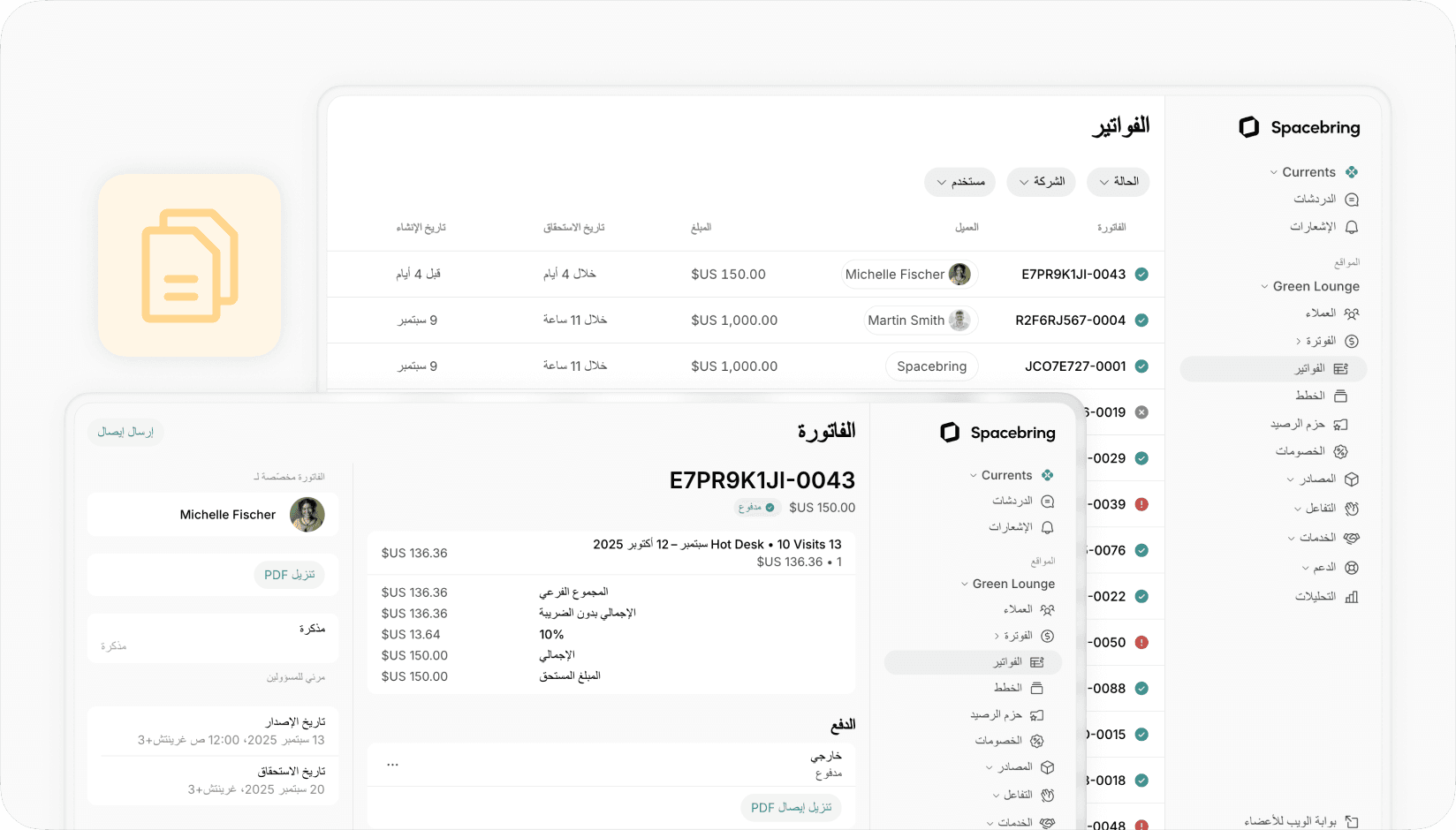

- Automated VAT-compliant invoicing: Your software should automate the generation of VAT-compliant invoices. The ability to set your local tax rate once and have the system apply it accurately to all transactions is a non-negotiable feature that minimizes errors and ensures regulatory compliance.

Step 2: Configure your automated financial system

After selecting your software, the initial setup is a critical investment of time that will yield significant long-term efficiencies.

- Configure billing and tax information: Begin by entering your company’s banking details and, most importantly, configuring the appropriate VAT rate for your jurisdiction.

- Connect your payment gateway: Integrate your Tap account with the platform. This is typically a straightforward authorization process that activates the full range of regional payment methods for your members.

- Define membership plans: Structure your various membership offerings with clear pricing, billing cycles (e.g., monthly, quarterly, annually), and a detailed list of included services and amenities.

- Onboard member data: Import your existing members' information and assign them to their respective membership plans. The system will then manage the recurring billing cycle automatically. Notably, platforms like Spacebring do not charge additional commissions on transactions processed through the Tap integration, ensuring a cost-effective solution.

Step 3: Automate billing for all one-off services

Revenue is often generated from sources beyond recurring memberships, including meeting room rentals, day passes, and event space bookings. Automating payment for these services is key to operational efficiency.

By enabling instant online payments, both members and non-members can book and pay for services in a single, seamless transaction. For example, a non-member can book a meeting room through your website or app and complete the payment immediately, receiving an automated, compliant invoice without any manual intervention from your team. This self-service model improves the customer experience and ensures all revenue is captured promptly.

Step 4: Streamline accounting for flawless local compliance

To maintain accurate financial records and ensure you meet all local regulations, it is vital that your operational software communicates directly with a compliant accounting platform.

Integrating your coworking management system with accounting software like QuickBooks Online or Xero automates the synchronization of all financial data. This eliminates the need for manual data entry, which is a common source of errors.

However, for businesses in the GCC, and especially in Saudi Arabia, compliance is paramount. For instance, in KSA, businesses must adhere to the regulations set by the Zakat, Tax and Customs Authority (ZATCA), which includes the mandatory e-invoicing (Fatoorah) system.

This is a critical consideration. While international platforms are widely used, you must ensure your chosen accounting software is fully compliant with ZATCA's requirements. In some cases, dedicated regional platforms like Zoho Books may offer more deeply integrated and up-to-date compliance features for specific regulations like e-invoicing.

The right integration gives you and your accountant a real-time, accurate overview of your company's financial health, greatly simplifying both financial reporting and your mandatory VAT and ZATCA filings.

Step 5: Differentiate your space with a superior digital member experience

In the highly competitive coworking markets of Dubai, Riyadh, and Doha, the quality of your member experience is a powerful differentiator. The population is tech-savvy and has high expectations for seamless digital service. A clunky, manual process for bookings or payments is no longer acceptable.

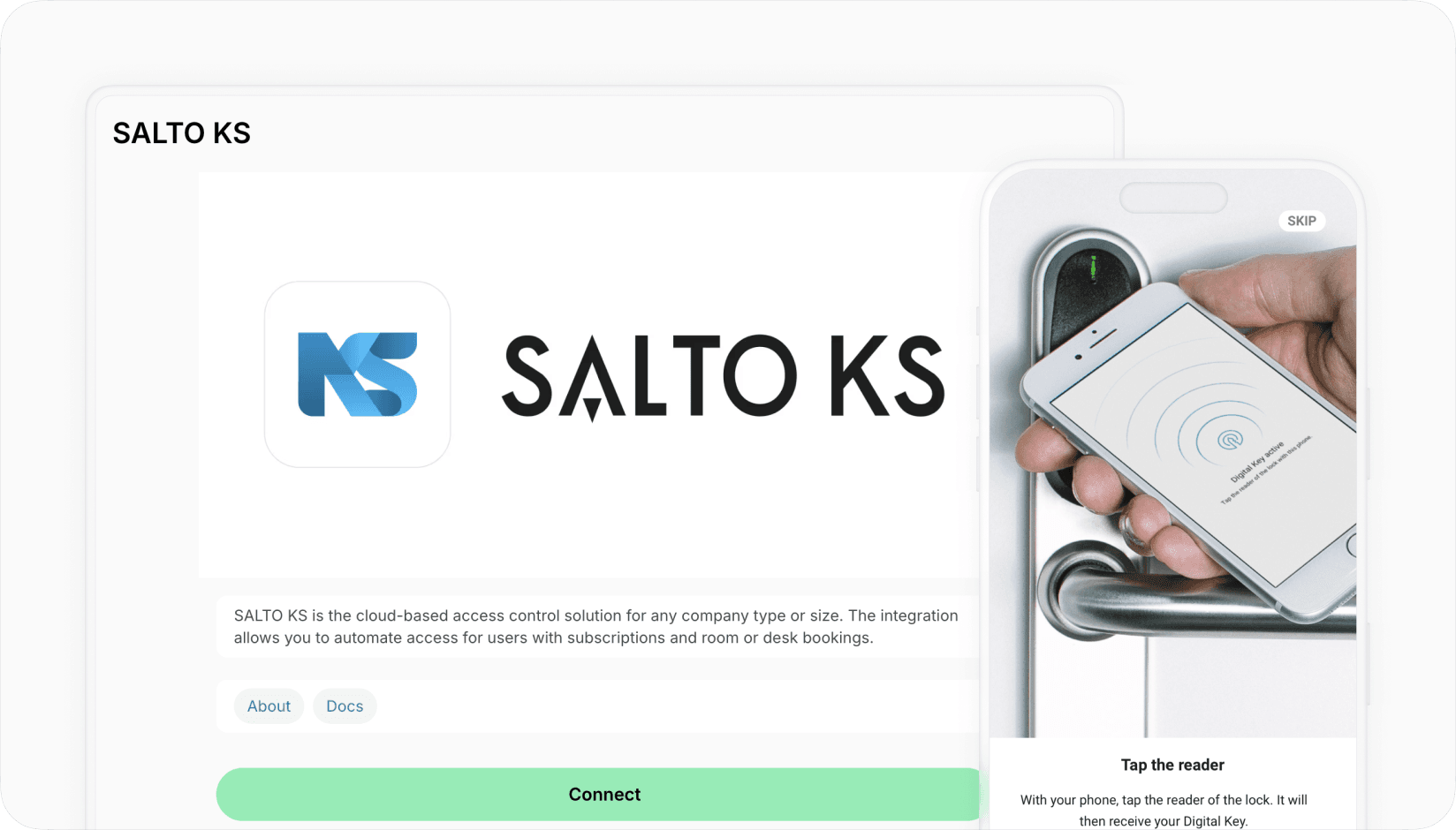

- Deliver true 24/7 self-service: The business culture in the GCC is fast-paced and operates outside of traditional 9-to-5 hours. This is where integrating your management software with an access control system like SALTO KS becomes essential. A new member can sign up on your website at 10 PM, have their payment processed automatically, and instantly receive digital keys on their phone to access the space—all without any staff intervention.

- Cater to an international and diverse membership: Your members come from across the region and the world. Providing a sophisticated member portal where they can independently manage their accounts, download invoices in the correct format, and update payment details in both English and Arabic is essential for providing a world-class, inclusive service.

- Build loyalty through frictionless, secure interactions: Every time a member can accomplish a task instantly—from paying an invoice to accessing a booked meeting room with their phone—you strengthen your relationship. Automating this entire journey, from payment to physical access, eliminates friction, enhances security, and contributes directly to higher member satisfaction and retention.

Conclusion: Focusing on growth through operational excellence

By strategically automating your payment and invoicing processes with a platform designed for the GCC, you can move beyond day-to-day administrative tasks. This allows you to focus your energy on strategic initiatives: enhancing your community, expanding your services, and driving the long-term growth of your business.

To learn how these solutions can be tailored to your specific business, we invite you to book a free one-on-one demonstration call with a Spacebring expert and explore the benefits of a fully automated, regionally optimized platform.